maricopa county irs tax liens

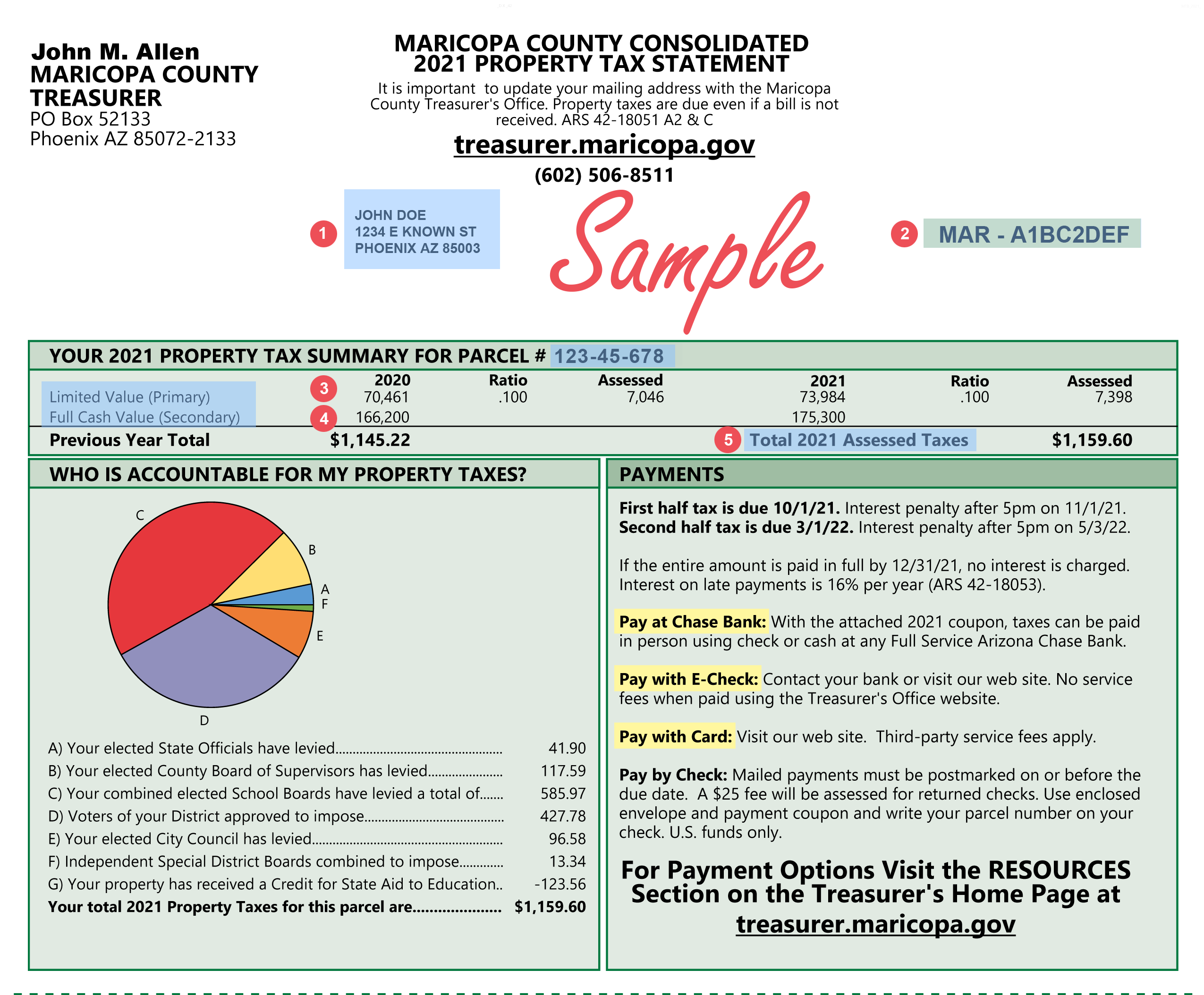

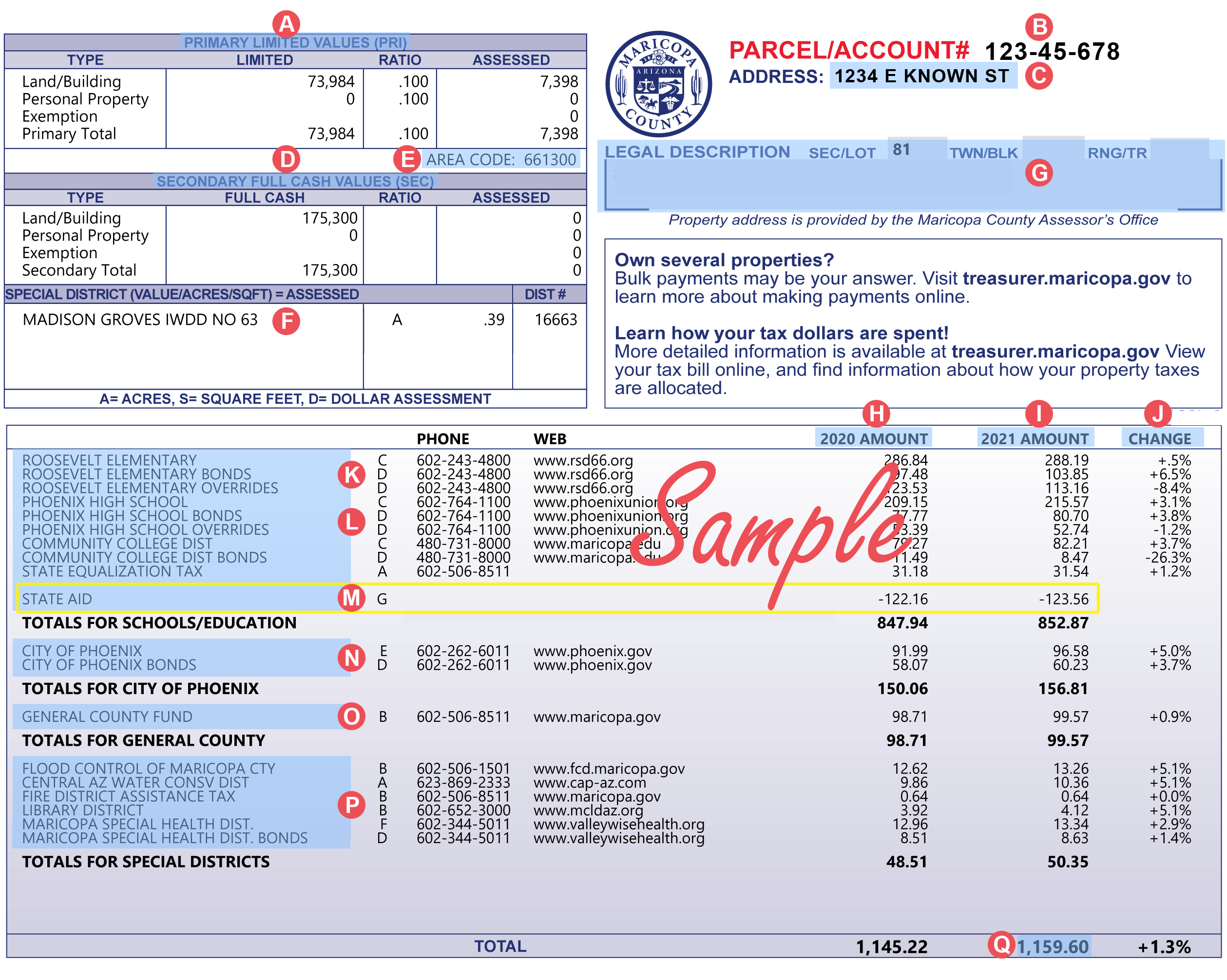

Just remember each state has its own bidding process. The interest rate paid to the county on delinquent taxes is 16.

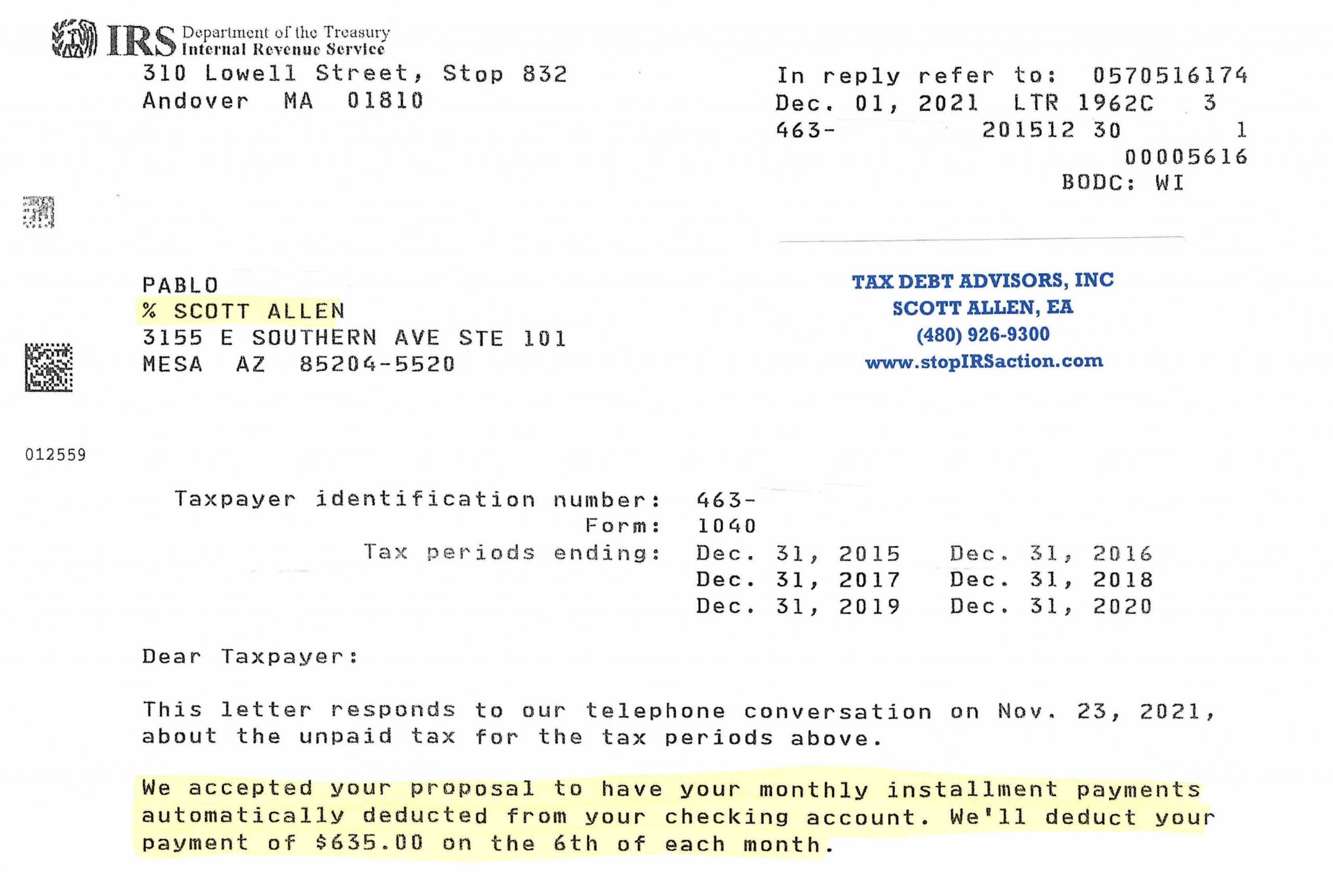

Offer In Compromise Tax Debt Advisors

It walks through the application forms supporting documents needed how to submit an application and how the process works.

. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest.

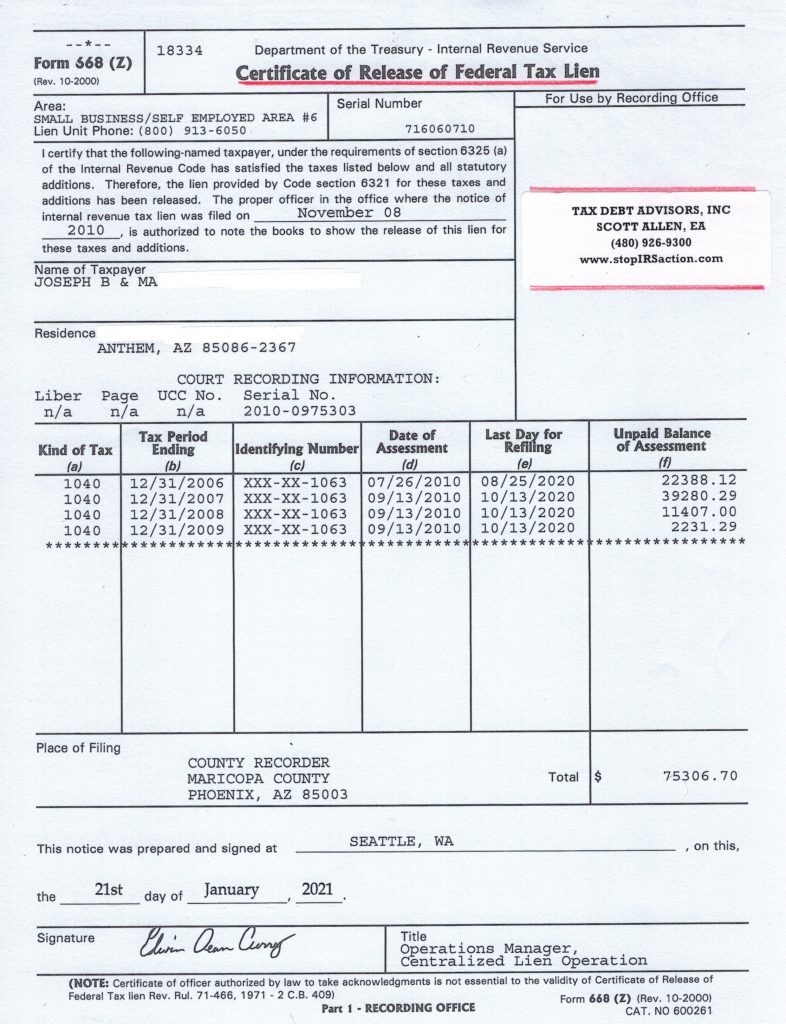

Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the State of Arizona. Check your Arizona tax liens rules. Selling or Refinancing when there is an IRS Lien This is the complete video which is also divided into 3 segments below for convenience.

Click here to download the available State CP list. All groups and messages. It explains the federal tax lien discharge and subordination process.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. When a lien is auctioned it is possible for the bidder to achieve that rate too. However since the early 1990s CD interest rates have been low and rates achieved by investors have been in the 4-8 range.

Then the taxpayer is sent a letter with a notice and demand which informs the taxpayer. Maricopa County AZ currently has 22642 tax liens available as of February 14. The Tax Lien Auction.

If you do not see a tax lien in Arizona AZ or property that suits you at this time subscribe to our email alerts and we will update you as new Arizona. The Tax Lien Sale will be held on February 9 2021. Please allow 2-3 weeks for the full release to post with the appropriate County Recorders Office andor Secretary of State.

Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be provided within 24 hours to the taxpayer. The initial step is for the IRS or local tax agency to decide that a person truly owes back taxes and that it is worth the effort to impose a lien.

The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order certified check or wire transfer for the approximate total. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map.

Preview and bidding will begin on January 26 2021. I acknowledge having read the above disclaimer and waive all rights I may have to claim against Maricopa County its officers departments employees and agents arising out of my reliance. Purchase requests will be recorded and processed in the order in which they are received.

Visit Arizona tax sale to register and participate. The Court adjudicates cases involving state taxes municipal sales taxes and property taxes as well as appeals from the Property Tax Oversight Commission. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales.

Learn to buy tax liens in Maricopa County AZ today with valuable information from. These parcels have been deeded to the State of Arizona as a result of a property owners failure to pay property taxes on the parcel for a number of years.

Response To Petition For Legal Separation With Children Drlsc31f Pdf Fpdf Docx

Hurf And Vlt Distributions To Pima County Reach Record Breaking Levels Arizona Daily Independent

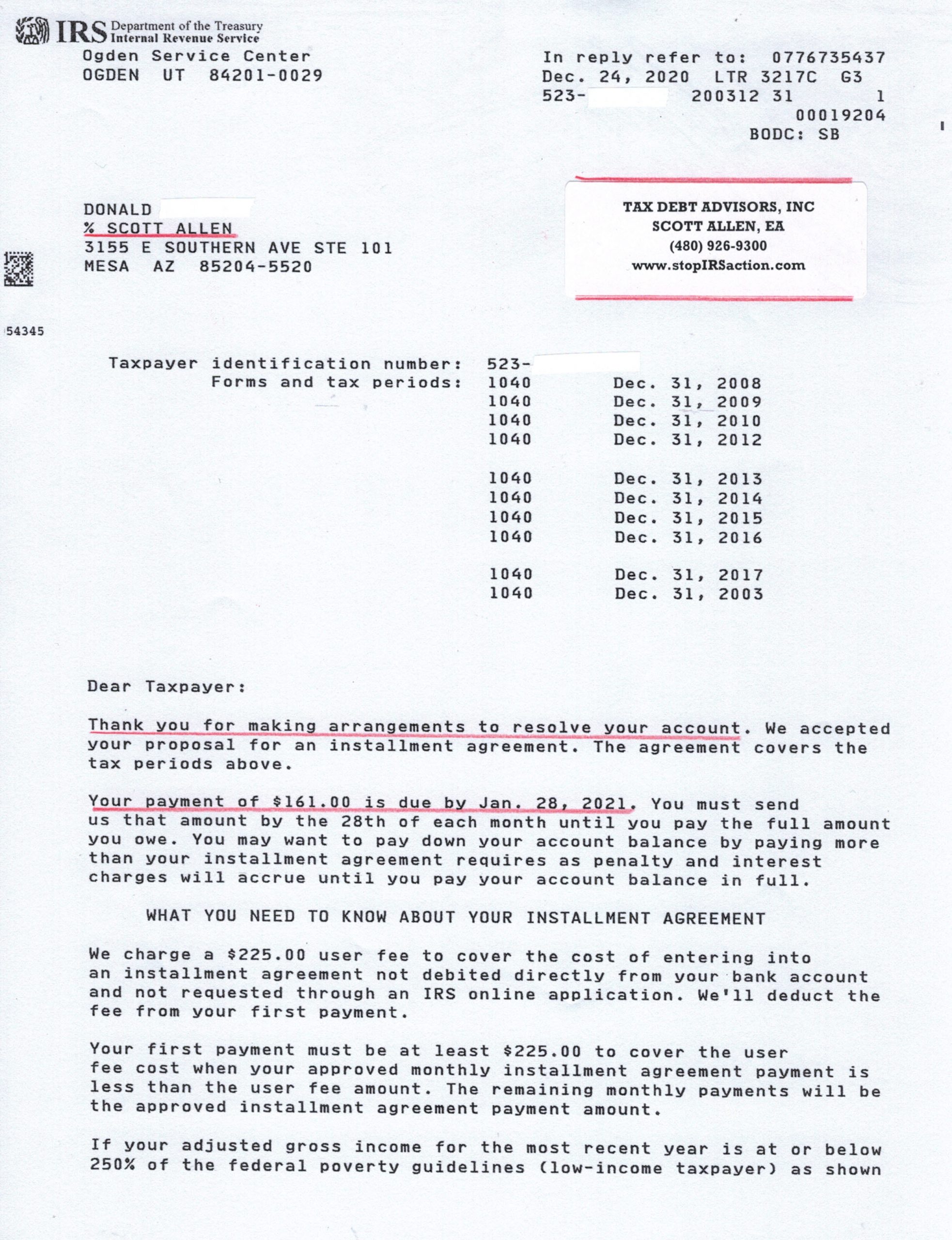

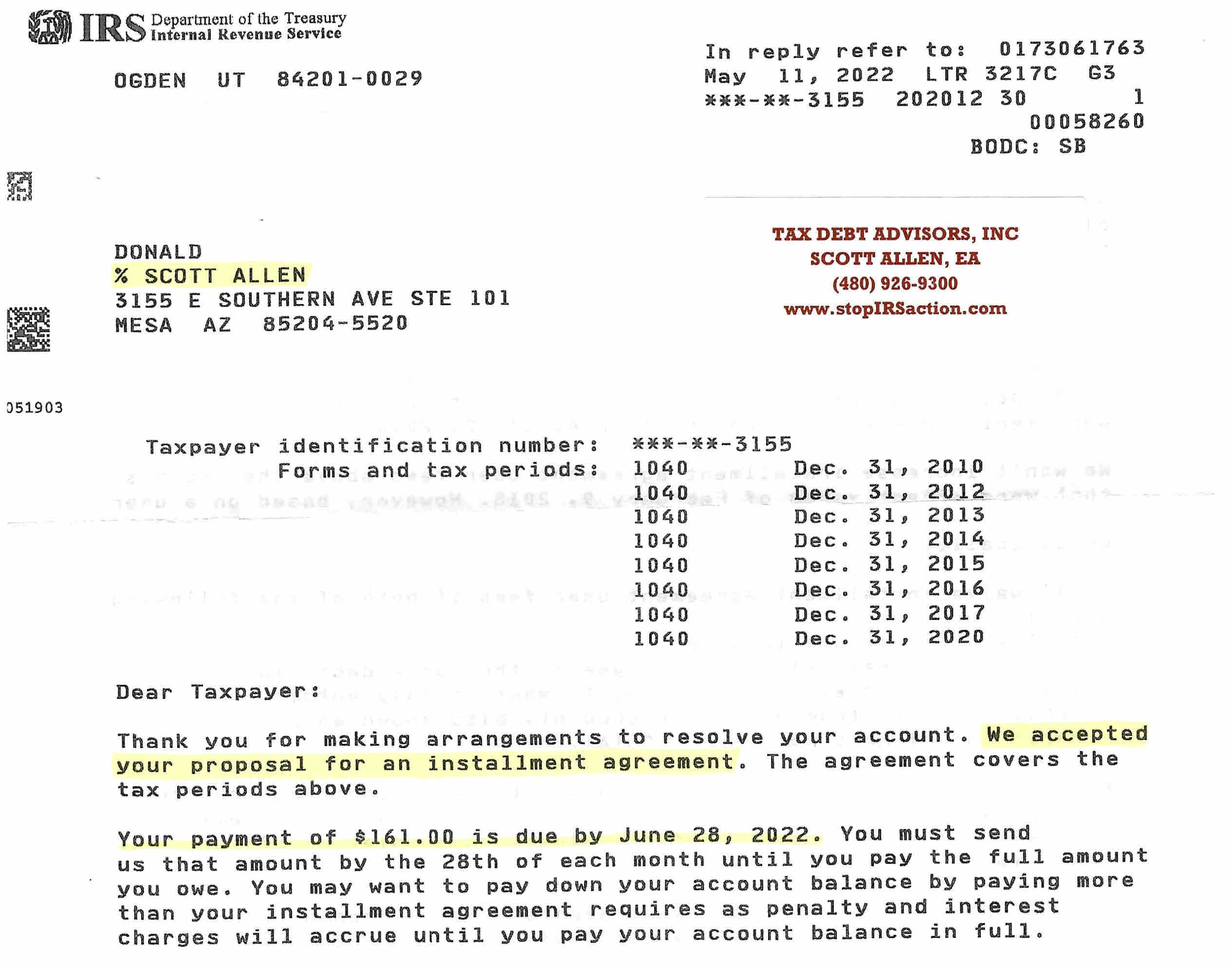

Irs Tax Lien Problems Tax Debt Advisors

Pin By Sun City Home Owners Associati On Schoa Sun City Arizona House Styles Mansions

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

An Interview With The Maricopa County Treasurer Asreb

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

The Basics Of Tax Liens Arizona School Of Real Estate And Business